9M-2016-report-MCS-Groupe

DEFINITIONS AND GLOSSARY

Attributable Cash EBITDA means our Cash EBITDA for a given period after subtracting interest distributions to co-investors for their participation in our consolidated SPVs;

Attributable ERC refers to Gross ERC after taking into account the pro rata share of such collections that will be attributable to co-investors pursuant to contractual arrangements with such co-investors in SPVs;

Cash EBITDA means our total cash revenue for the period (Gross Collections and other revenue), after subtracting professional fees and services, personnel costs and committed costs;

Cash Revenue means our Gross Collections for a period after adding the revenue generated from our third-party servicing business;

Company means MCS et Associés SAS, a French société par actions simplifiée having its registered office at 256 bis, rue des Pyrénées, 75020 Paris, France and registered in France under sole identification number 334 537 206 R.C.S. Paris;

Convertible Bonds means the convertible bonds issued by the Parent and subscribed by Promontoria Holding 85 B.V.;

FCTs means fonds commun de titrisation, which are investment funds contractually organized under French law for the purposes of holding debt portfolios;

Group, MCS, we, our and us collectively, the Parent and its direct and indirect subsidiaries including the SPVs that are consolidated into the Parent’s consolidated financial statements;

Gross Collections refer to the cash proceeds received from the debtors related to the debt portfolios that the Group or its SPVs purchased, before allocation of the pro rata share of Gross Collections attributable to co-investors (if any). Gross Collections are presented prior to factoring any legal fees or other collection activity costs;

Gross ERC refers to our estimated remaining collections on our purchased debt portfolios, which represents the expected gross cash proceeds over, as applicable, an 84- or 120-month period from our purchased debt portfolios, assuming no additional purchases are made and on an undiscounted basis before taking into account the pro rata share of such collections that will be attributable to co-investors;

Hugo Buyback refers to the buyout of minorities in the amount of €17.6 million from Hugo I (36.2% interest purchased), Hugo II (18.3% interest purchased) and Hugo III (40% interest purchased) FCT funds on July 25, 2014;

Issuer means Promontoria MCS SAS, a French société par actions simplifiée à associé unique having its registered office at 256 bis, rue des Pyrénées 75020 Paris, France and registered in France under sole identification number 802 951 848 R.C.S. Paris;

Parent means Promontoria MCS Holding SAS, a French société par actions simplifiée having its registered office at 256 bis, rue des Pyrénées 75020 Paris, France and registered in France under sole identification number 802 992 602 R.C.S. Paris, which directly owns 100% of the share capital of the Issuer;

SPV means special purpose vehicle, and as used herein shall include FCTs.

FINANCIAL HIGHLIGHTS FOR THE NINE MONTHS ENDED SEPTEMBER 30 2016

- Gross Collections of €63.7m, up 21% y/y

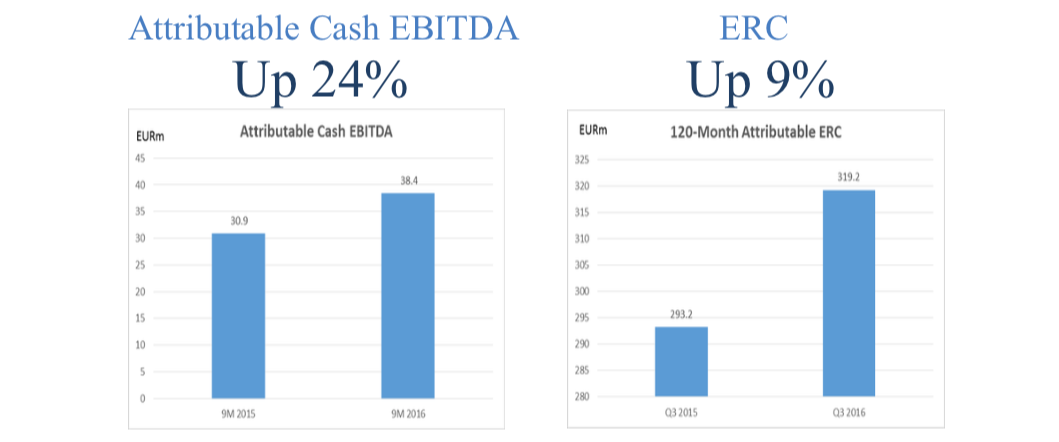

Attributable Cash EBITDA of €38.4m, up 24% y/y - ERC of €319m, up 9% y/y

Leverage ratio on LTM Attributable Cash EBITDA at 2.2x

BUSINESS REVIEW FOR THE NINE MONTHS ENDED SEPTEMBER 30 2016

During the first nine months of 2016, we have seen significant positive developments related to each of the three pillars of our mid-term strategy, which are the following:

- Secure our market leading position through organic and external growth;

- Maintain our disciplined portfolio acquisition policies to maximize return on our capital;

- Further diversify our revenue streams by expanding our third-party performing loan servicing business.

We have indeed seen a strong dynamic in terms of portfolios acquisitions over the past nine months. During that period, we have acquired €21m worth of portfolios, more than double our acquisitions during the same period last year. Looking at the last twelve months, this puts us at an aggregate €46m worth of acquisitions, confirming the growth of the French market, as well as our ability to build on our position as a leading purchaser and servicer of high-balance retail debt in France.

We have leveraged our robust due diligence process and analytics tools to ensure that we only acquired portfolios of non-performing and performing loans that present attractive economics. In particular, we did continue to invest in complex portfolios of large non-performing loans that provide favorable returns in a low interest-rate environment.

We have also enjoyed a robust growth in our performing loan servicing business, based on the solid ramp-up of our existing contracts. We have had constructive discussions with numerous prospects. These have led us to formulate creative business propositions which we believe will deliver significant results next year and enable us to increase our volume of predictable, long-term recurring revenue.

Operating performance also proved to be satisfactory, with our Gross Collections showing a 21% increase during the first nine months of 2016 compared to last year. This enabled us to continue to invest in both our people and our systems as well as posting a 24% rise in our Attributable Cash EBITDA vs. last year, which stands at €38.4m. When considered over the last twelve months (LTM), Attributable Cash EBITDA stands at €54.2m, up 13%. 120- Month Attributable ERC increased from €293.2m as at September 30, 2015 to €319.2m as at September 30, 2016, up 9% or €26.0m, reflecting the growth of our debt purchasing activities, all the more remarkable as our Gross Collections evidenced strong performance over the period.

Lastly, we have refinanced our group in September through a successful, first-time €200m bond issuance that provides us with ample long-term financing. We have continued to grow our asset base whilst maintaining moderate leverage levels, with a leverage ratio on LTM Attributable Cash EBITDA of 2.2x at September end.

Prospects for Q4 16 and the beginning of 2017 are encouraging, and should allow us to make good use of our c. €80m of cash. We have seen a combination of new transactions from our long-standing clients, as well as new entrants considering first-time portfolio sales. We believe that our group is well positioned to take advantage of these opportunities.

ISSUER AND SHAREHOLDERS

The Issuer

The Issuer is a direct, wholly-owned subsidiary of the Parent that was incorporated on June 17, 2014 as a société par actions simplifiée (société à associé unique) under the laws of France in order to facilitate the Cerberus Acquisition. Consequently, no Group-wide consolidation is performed at the level of the Issuer and the historical financial information relating to the Issuer on a standalone basis is not meaningful and has not been included in this quarterly report. Rather, we have included and discussed in this quarterly report the unaudited condensed interim consolidated financial statements of the Parent as of and for the nine months ended September 30, 2016.

Note that the only material difference between the financial statements of the Issuer and the Parent relates to the Convertible Bonds, issued by the Parent.

The Parent

The Parent was incorporated on June 18, 2014 as a société par actions simplifiée (société à associé unique) under the laws of France in order to facilitate the acquisition of the Group by funds advised by Cerberus Capital Management L.P. (“Cerberus”) and to serve as the holding company of the Group post-acquisition.

The Issuer is directly wholly owned by the Parent. The Parent is indirectly owned by entities indirectly controlled by funds advised by Cerberus which own 63.3% of its share capital and by several management shareholding entities directly and indirectly held by the management which collectively own the remaining 36.7% of the share capital of the Parent.

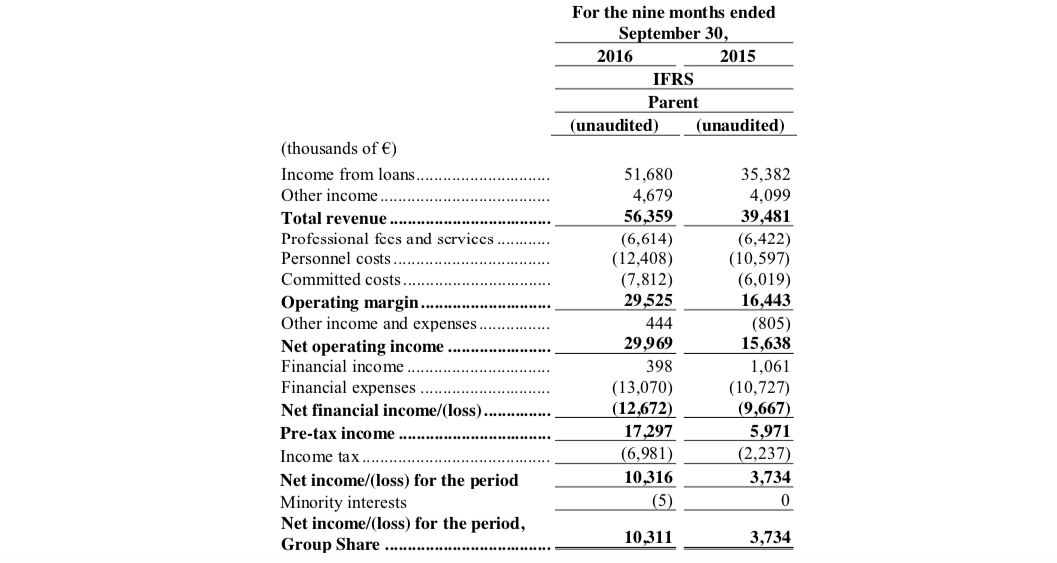

FINANCIAL REVIEW FOR THE NINE MONTHS ENDED SEPTEMBER 30

Our performance during the first nine months of 2016 shows substantial growth compared to the same period last year.

Income from loans increased from €35.4m to €51.7m for the nine months ended September 30, 2016, up 46% or €16.3m, reflecting inter alia the strong performance of the Gross Collections related to our back book as well as our growing asset base.

Other income increased by 14% to €4.7m for the first nine months of 2016. This increase was primarily due to the ramp-up of activity generated by servicing contracts signed in 2014 and 2015, especially in our performing loan servicing division.

As a result, total revenues increased by €16.9m to €56.4m for the nine months ended September 30, 2016, from €39.5m for the nine months ended September 30, 2015, up 43%.

Professional fees and services increased by €0.2m, or 3%, to €6.6m for the nine months ended September 30, 2016. This increase was primarily driven by the increase in Gross Collections during this period. However, when considered as a percentage of total revenues, professional fees and services decreased by 4.5 percentage points to 11.7% for the nine months ended September 30, 2016.

Personnel costs increased by €1.8m, or 17%, to €12.4m for the nine months ended September 30, 2016. This increase was attributable to the full-period effect of hires made in 2015, continued hires in 2016, as well as a higher amount of employee profit-sharing due to the Group’s strong performance. During the first nine months of 2016, our headcount have increased from 226 to 242.

Committed costs increased by €1.8m to €7.8m for the nine months ended September 30, 2016. This increase was primarily due to the relocation of the Group’s headquarters to new facilities in November 2015, which led us to incur redundant leasing expenses until May 2016.

The change in other income and expenses over the period is primarily related to the disposal of our previously owned premises.

Our net financial result for the first nine months of 2016 mostly reflects our past financial structure, as our €200m bond issuance occurred on September 28, 2016, at the end of the period.

Income tax increased by €4.7m to €7.0m for the nine months ended September 30, 2016. This increase was primarily due to the increase in pre-tax income during the same period.

As a result of the foregoing, net income for the period increased by €6.6m to €10.3m for the nine months ended September 30, 206, from €3.7m for the nine months ended September 30, 2015

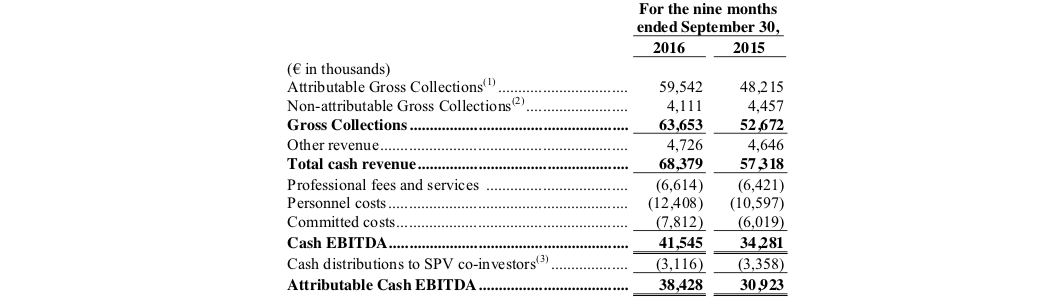

Cash EBITDA and Attributable Cash EBITDA

For the nine months ended September 30, 2016, Attributable Cash EBITDA was €38.4m, as compared to €30.9m for the nine months ended September 30, 2015, representing an increase of €7.5m, or 24%. This increase was primarily attributable to an increase in Attributable Gross Collections (+23%) while operating expenses increased by 16% over the same period.

The following is a reconciliation from Gross Collections to Cash EBITDA and Attributable Cash EBITDA for the periods indicated.

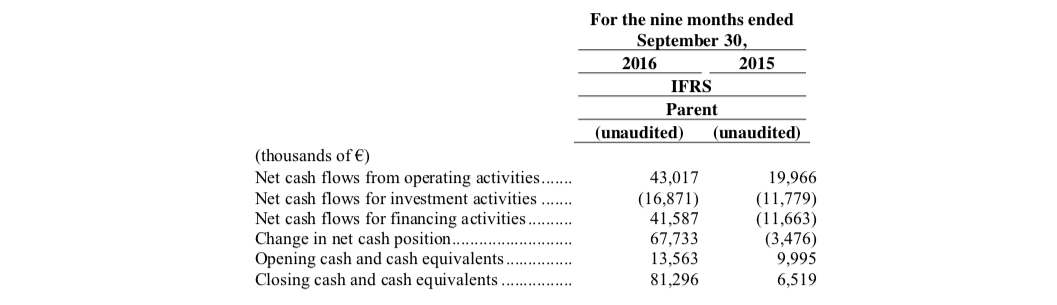

Cash Flows

Our cash situation has largely improved during the first nine months of 2016, reflecting the strong cash-generative nature of our operations as well as the successful completion of our €200m bond issuance on September 28, 2016, which gives us significant headroom for growth with more than €80m of available cash at the end of the current period.

Net cash flows from operating activities

Net cash flows from operating activities for the nine months ended September 30, 2016 were recorded at €43.0m, reflecting the strong performance of our Attributable Gross Collections.

Net cash flows for investment activities

Net cash flows used for investment activities for the nine months ended September 30, 2016 were recorded at €16.9m, driven by the increase in our portfolio purchases activity (€21m worth of acquisitions made during the first nine months of 2016) albeit mitigated by the sale of two Group’s real-estate business properties following our headquarters’ relocation.

Net cash flows for financing activities

Net cash flows from financing activities for the nine months ended September 30, 2016 were recorded at €41.0m. This significant increase was primarily attributable to our €200m bond issuance. As indicated in the Offering Memorandum, the proceeds have been partly used to reimburse prior existing indebtedness of the Group, as well as paying a distribution to our shareholders.

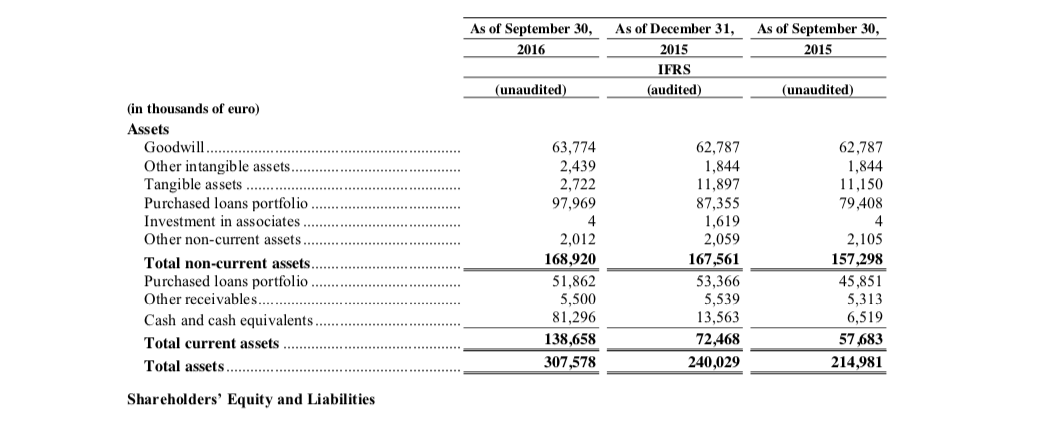

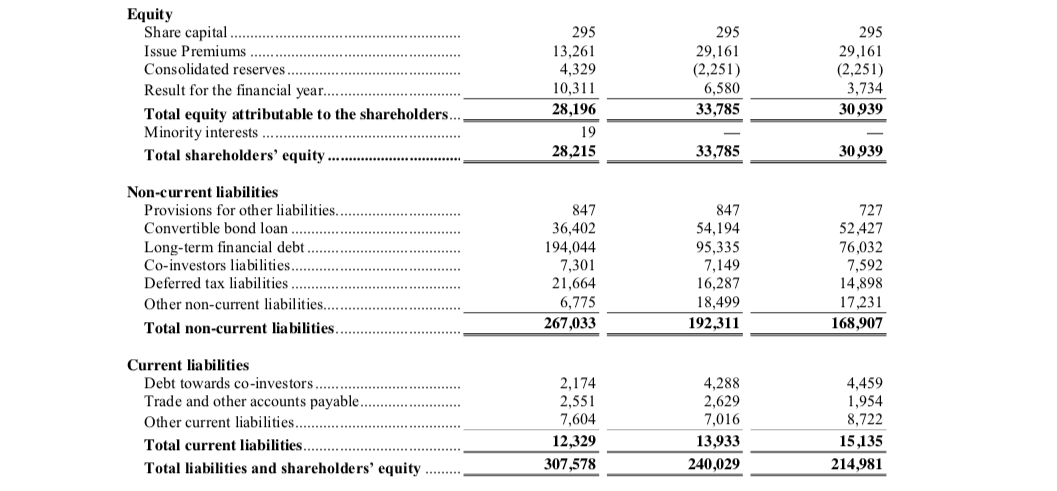

Consolidated Balance Sheet Data

Funding

After our refinancing secured in September 2016, our funding consists of a Super Senior RCF of €25m and Senior Secured Floating Rate Notes of €200m. The RCF is priced at a margin within a 3.25%-3.50% range, with a commitment fee equivalent to 35% of the applicable margin on any undrawn amount. The Senior Secured Floating Rate Notes have a 5-year maturity with an interest rate of Euribor + 5.75% (with a 0% floor). As of September 30, 2016, no amounts had been drawn under the RCF.

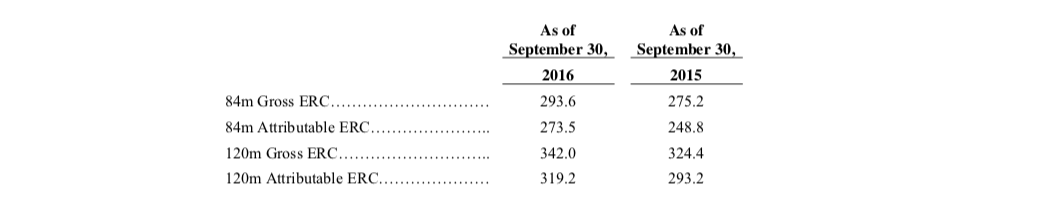

Gross ERC and Attributable ERC

Gross ERC refers to the estimated remaining collections that we have recorded based on the debt portfolios we own or have rights to collect at some point in time, before taking into account the pro rata share of such collections that will be attributable to any co-investors. Attributable ERC refers to Gross ERC after taking into account the pro rata share of such collections that may be attributable to co-investors pursuant to contractual arrangements with such co-investors in SPVs.

120-Month Attributable ERC increased from €293.2m at September-end 2015 to €319.2m at September-end 2016, up 9% or €26.0m. This reflects the growth of our debt purchasing activities, all the more remarkable as our Gross Collections evidenced strong performance over the period.

The table below sets forth our Gross ERC and Attributable ERC for the periods indicated.

SIGNIFICANT RISKS AND UNCERTAINTIES

Our risks are described in more detail under the caption “Risk Factors” in the offering memorandum dated September 21, 2016 related to the issuance of our Senior Secured Floating Rate Notes due 2021.

The Group’s risks include, among other things, strategic risks related to economic development and acquisitions, regulatory changes, possible errors and omissions and financial risks such as market risk, funding risk and credit risk inherent to a debt purchasing business, as well as counterparty risk for our third-party servicing business.

EVENTS AFTER THE END OF THE PERIOD

In November 2016, we have changed the split of responsibilities among some of our Executive Committee members. The main change was the creation of a Chief Investment Officer position, which Pascal Falconnet has agreed to take. We have also centralized all non-performing loan operations teams under a single Chief Operating Officer. Cyrille de Courson, who was already supervising half of our non-performing loan teams, is now leading this unified organization. In their respective positions, both Pascal and Cyrille will continue to report to the CEO.

Regarding portfolio acquisitions, Q4 16 has started on a strong note, with significant transactions from our pipeline materializing into attractive investment opportunities.

FORWARD LOOKING STATEMENTS

This quarterly report contains forward-looking statements within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 and the securities laws of other jurisdictions. In some cases, these forward looking statements can be identified by the use of forward-looking terminology, including the words “believes”, “estimates”, “aims”, “targets”, “anticipates”, “expects”, “intends”, “plans”, “continues”, “ongoing”, “potential”, “product”, “projects”, “guidance”, “seeks”, “may”, “will”, “could”, “would”, “should” or, in each case, their negative, or other variations or comparable terminology or by discussions of strategies, plans, objectives, targets, goals, future events or intentions. These forward-looking statements include matters that are not historical facts. They appear in a number of places throughout this quarterly report and include statements regarding our intentions, beliefs or current expectations concerning, among other things, our results of operations, financial condition, liquidity, prospects, competition in areas of our business, outlook and growth prospects, strategies and the industry in which we operate.

By their nature, forward-looking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future. We caution you that forward-looking statements are not guarantees of future performance and that our actual results of operations, financial condition and liquidity and the development of the industry in which we operate may differ materially from those made in or suggested by the forward-looking statements contained in this quarterly report. In addition, even if our results of operations, financial condition and liquidity, and the development of the industry in which we operate are consistent with the forward-looking statements contained in this quarterly report, those results or developments may not be indicative of results or developments in subsequent periods. For a description of important factors that could cause those material differences, we direct you to the section entitled “Risk Factors” of our Offering Memorandum and “Significant Risks and Uncertainties” above.

In addition, in this quarterly report we present the metrics Gross ERC and Attributable ERC, which are used by management as tools in order to analyze the performance of our business. Gross ERC and Attributable ERC represent a projection of our estimated remaining collections over, as applicable, an 84-month and 120-month period prior to taking into account the pro rata share attributable to co-investors and after taking into account such pro rata share, respectively. Each of Gross ERC and Attributable ERC is calculated using internal forecasts, extrapolations based on historical performance of the Group and extrapolations based on portfolio historical performance. Each of Gross ERC and Attributable ERC is inherently forward-looking in nature and there can be no guarantee that we will achieve such collections.

The forward looking statements are based on plans, estimates and projections as they are currently available to our management. We undertake no obligation, and do not expect, to publicly update or publicly revise any forward- looking statement, whether as a result of new information, future events or otherwise. Although we believe that the expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such expectations will prove to be correct. All subsequent written and oral forward looking statements attributable to us or to persons acting on our behalf are expressly qualified in their entirety by the cautionary statements referred to above and contained elsewhere in this quarterly report.